work in process inventory balance formula

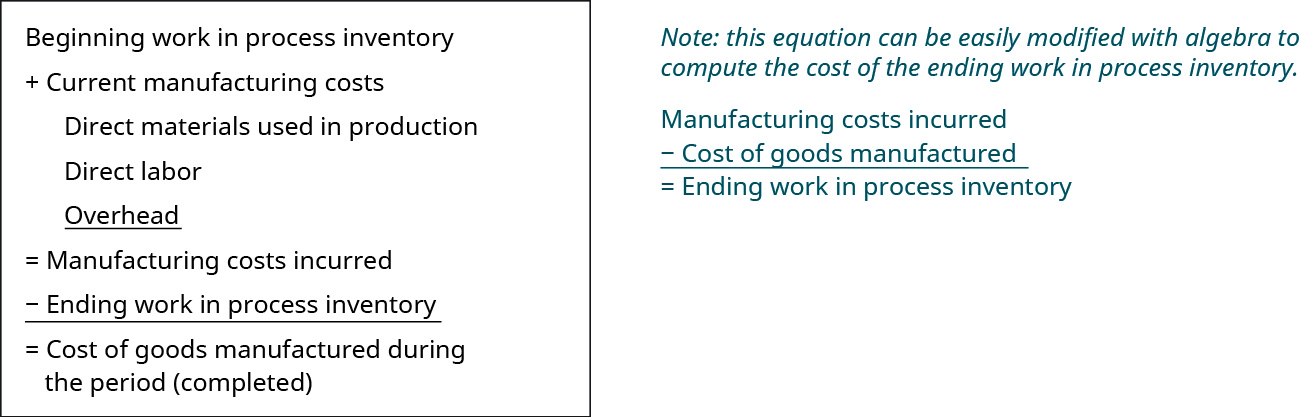

The formula for calculating WIP inventory is. Ending work-in-process beginning work-in-process all manufacturing costs during the period - cost.

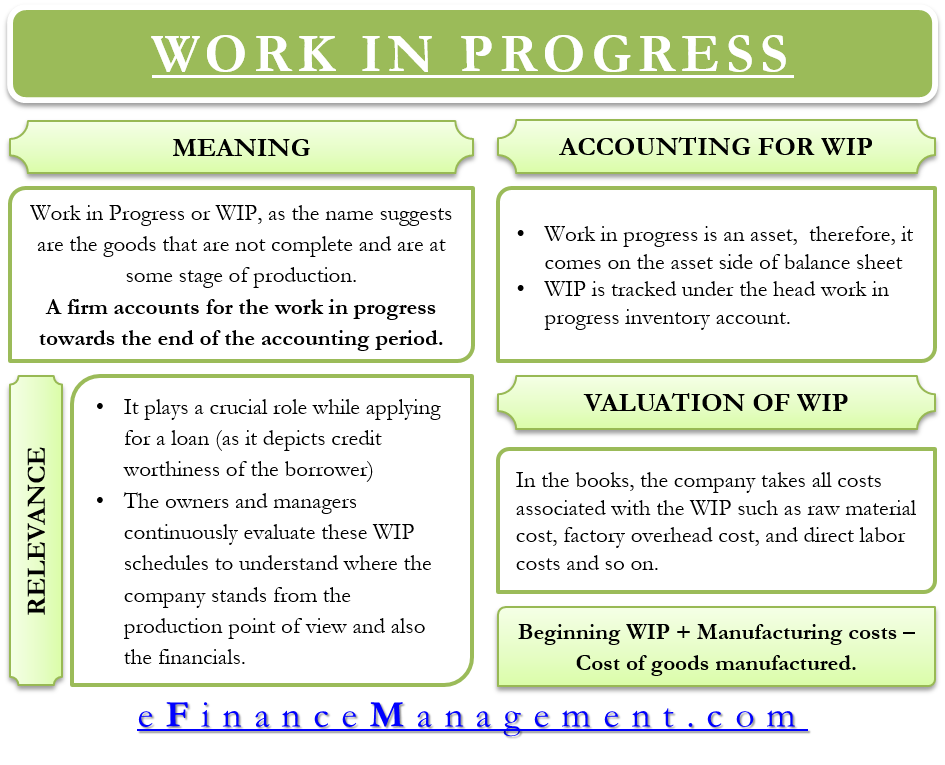

What Is Work In Process Wip Inventory Definition Formula And Benefits Article

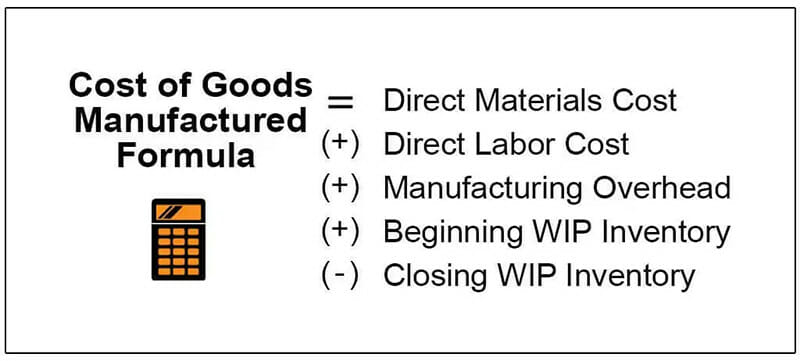

Higher sales and thus higher cost of goods sold leads to.

. It is the total costs transferred from work-in-process inventory to final goods inventory. Also known as COGM the cost of manufactured goods is the total costs incurred in the making of a final product. The costs What Is Work In Process Inventory And How included in the work-in-process inventory account are direct materials direct labor and manufacturing overhead.

The work in process formula is. If youre a new business and you dont have an ending inventory balance. 10000 300000 250000 60000.

However by using this formula you can get only an. This means that Crown Industries has 10000 work in process inventory with them. The difference between the sum of the beginning work in process and the costs of manufacturing is the ending work in process.

Take a look at how it looks in the formula. Work in process inventory 60000. Its calculated from the cost of goods sold COGS plus the ending inventory balance minus the cost of purchases.

8000 240000 238000 10000. Work-in-process is considered an asset and is recorded in the inventory line item on balance sheets. You have to know the final COGM to calculate the current WIP.

Ending WIP Inventory Beginning WIP Inventory Manufacturing Costs - Cost of Finished Goods. Work in process inventory formula. Ending Inventory Beginning Balance Purchases Cost of Goods Sold.

How to Calculate Ending Work In Process Inventory. Ending WIP inventory beginning WIP inventory manufacturing costs COGM. The WIP figure indicates your company has.

The formula for this is as follows. We have worked with thousands of students from. It should be the smallest of the main inventory accounts according to Accounting.

Your WIP inventory formula would look like this. Ending Work in Progress Beginning WIP Manufacturing Costs Cost of Goods Manufactured. ABC International has beginning WIP of 5000 incurs manufacturing costs of 29000 during the month and records 30000 for the cost of goods manufactured during the.

In this formula COGM cost of goods manufactured. The beginning work in progress inventory is the ending WIP balance from the. WIP beginning WIP inventory manufacturing costs COGM As a work in process inventory example lets say your company starts the year with.

Work-in-process is inventory that has entered the production process but has not been completed at the balance sheet date.

What Is The Fifo Method Calculations Examples Impact Quickbooks

Inventory Formula Inventory Calculator Excel Template

8 4 Tracing The Flow Of Costs In Job Order Financial And Managerial Accounting

All You Need To Know About Wip Inventory

Accounting Treatment Of Work In Progress Explanation Examples Finance Strategists

Work In Progress Wip Definition Example Finance Strategists

Work In Process Inventory Formula Wip Inventory Definition

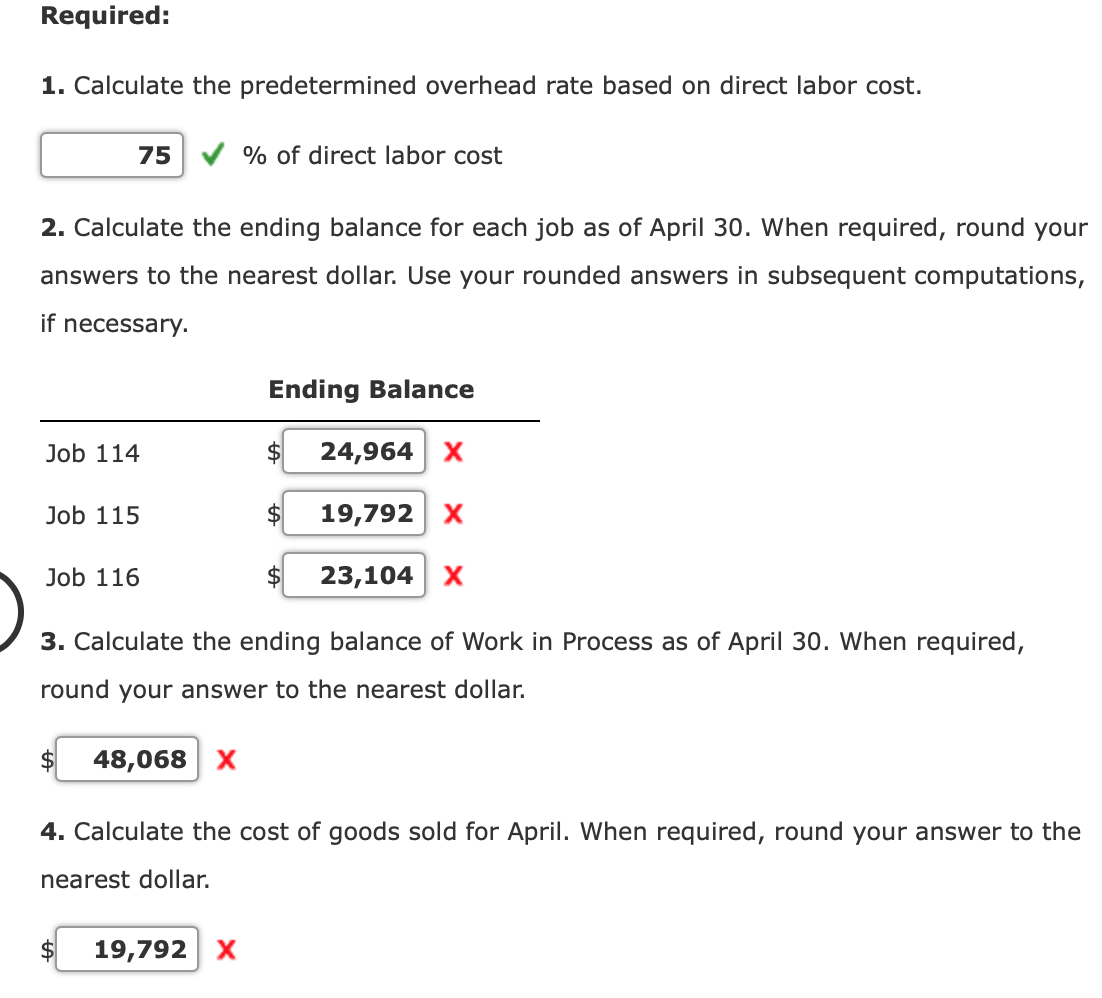

Solved Predetermined Overhead Rate Application Of Overhead Chegg Com

Work In Progress Wip Definition With Examples

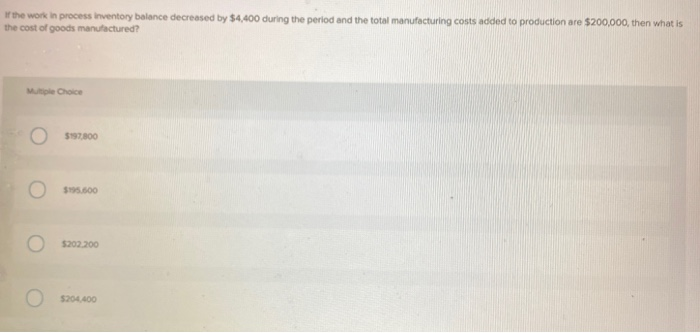

Solved In The Work In Process Inventory Balance Decreased By Chegg Com

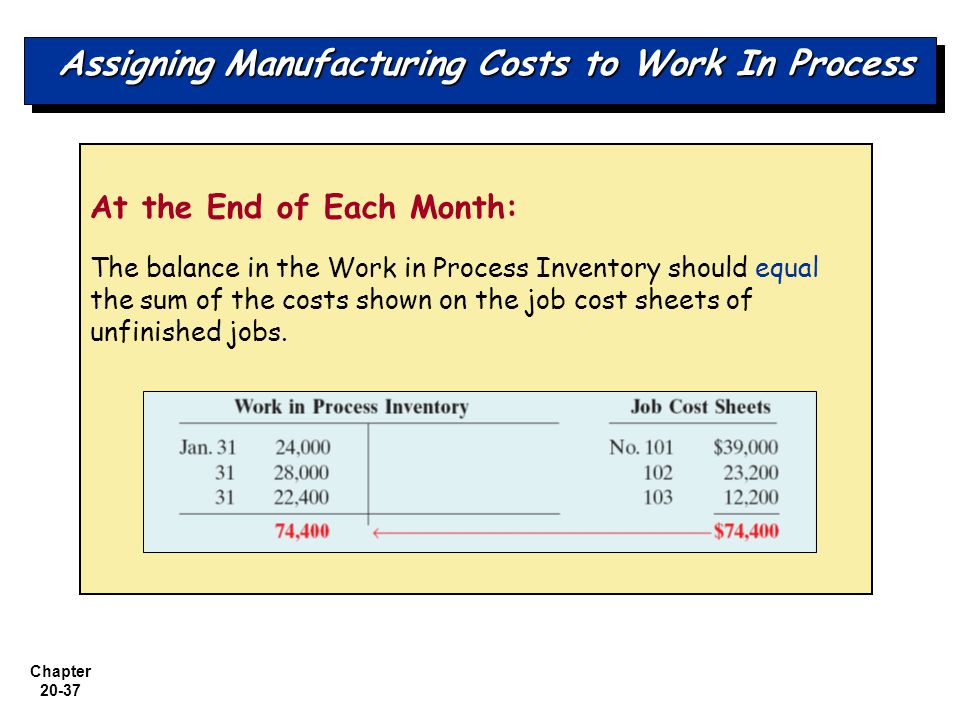

Chapter 19 Job Order Costing Ppt Download

Days Inventory Outstanding Dio Formula And Calculator

Building Blocks Of Managerial Accounting Chapter 2 Professor Debbie Garvin Jd Cpa Acg Ppt Download

Average Inventory Formula How To Calculate With Examples

What Is Work In Process Wip Inventory Definition Formula And Benefits Article

3 Types Of Inventory Raw Material Wip Finished Goods

Understanding Work In Process Inventory Definitions Formula Eworld Fulfillment

Why How To Calculate Work In Process Wip Inventory Value It Supply Chain